40% of Token Supply will be Airdropped to HyperTrend Users

Early users can claim their

share of the $TREND airdrop. 40% of total supply

is allocated to this one-time airdrop.

$TREND airdrops will generously reward

early adopters. The sooner you start the

more you will be awarded!

What Makes HyperTrend Unique In DeFi?

HyperTrend is an algorithmic trading protocol on the HyperEVM

blockchain. Users deposit USDC or HYPE into the HyperTrend vault,

which provides assets for the vault to trade with.

What makes HyperTREND unique is that it provides some of the

highest USDC stablecoin yields in DeFi, which is provided by

real revenues generated by its trading vaults. Our vaults have

a 3 year track record of profitable trading through both bull

and bear markets, and provide multiple tokenomics mechanisms

designed to accrue value directly into its token price.

Where do HyperTrend Yields Come From?

Yield on HyperTrend protocol comes from the profits generated inside our trading vault,

using our robust trading algorithms.

HyperTrend blends trend following, carry, basis trading, mean-reversion

and several more algorithms. These algorithms generate trading

profits, which is used to pay vault users and $TREND holders.

HyperTrend's Track Record

High Frequency Trading (HFT)

HFT systems underlying $TREND allow for faster, more profitable trading

Fully automated trading

Just connect your wallet, deposit funds and start earning

80%+ variable yield on USDC

Choose your preferred volatility targets to adjust your returns

Fully transparent & on-chain

ERC-4626 based vaults built on the HyperEVM

What Is "Number Go Up" Tokenomics?

We believe the winning formula for any token is to make its

holders wealthy. To align $TREND with this objective, we

have developed a unique set of mechanisms designed to transform

the demand for our product, directly into the price of our token.

We have coined these mechanisms, tongue-in-cheek, "number go up" tokenomics.

Frequently Asked Questions

$TREND is HyperTrend's native token, which has a fixed supply of 100 million tokens. Unlike most crypto projects, $TREND does not pay rewards from inflationary emissions. Instead, stakers earn USDC rewards from 20% of vault profits. The $TREND tokenomics by design — deflationary — which we call tongue in cheek, "number-go-up" tokenomics. Our tokenomics are designed to generate constant buyback pressure and zero new token issuance, creating long-term value accrual to $TREND holders. You can learn more in the documentation here.

$TREND generates yield from HyperTrend's algorithmic trading vaults. Stakers receive 20% of all vault profits paid in USDC (not inflationary token emissions). The protocol uses trend-following, carry, basis trading and mean-reversion trading systems in the crypto markets. With estimated 35% to 80% annual vault returns, this creates sustainable USDC yield for token holders without diluting supply.

Some of HyperTrend's trading strategies include:

Trend following — Captures sustained directional price movements by systematically buying assets with upward momentum and selling declining ones.

Carry — Generates returns by holding assets for inherent yield. Includes capturing funding rate differentials between perpetual futures and spot markets, staking yields, and interest rate differences across protocols.

Basis trading — Captures price discrepancies between related instruments, such as spreads between spot and futures contracts or price differences across exchanges. These arbitrage opportunities exist due to market inefficiencies and liquidity constraints.

Mean-reversion algorithms — Profits from asset prices reverting to statistical means after extreme moves. Identifies when assets move too far from fundamental value and positions for snapback.

Proprietary mechanisms — Operates on microsecond timeframes capturing tiny price inefficiencies through superior speed and execution. Includes market making, latency arbitrage, and order flow prediction.

Learn more about the trading strategies behind HyperTREND here

Deposit USDC or HYPE into HyperTrend vaults to earn 35-80% APY. You can also stake $TREND tokens to receive boosted yield, paid in USDC. Choose up to 3x leverage, stake for longer durations for higher yields, and trade your TLP tokens freely in markets.

Airdrop points are earned by depositing funds into HyperTrend vaults. In principle, if you are a genuine user of our products you can expect to earn airdrop points. Points accumulate based on deposit amount and duration over 6 months. Bonuses and points multipliers apply for early adopters, top HYPE airdrop recipients, Hypurr NFT holders, and active HyperEVM users. Participate in the referral program and leaderboard for additional points. Learn more here.

HyperTrend uses several profit-generating trading strategies instead of unsustainable token emissions. The team has 3+ years of proven trading performance, taken no VC funding, and the vault pays rewards in USDC. Unlike most DeFi projects offering approximately 4-10% yields, HyperTrend targets 35-80% returns through our proprietary algorithmic trading systems.

We believe the best advertising for any token is its price. Therefore, the token must take its holders on a wealth creation journey. To achieve this, we have designed the tokenomics of $TREND to align with this objective, with several "number go up" mechanisms built directly into the token.

HyperTrend protocol aims to solve persistent problems with extractive and unfair protocol tokenomics:

• Airdrops "farmable" by users who have no intention of doing anything but selling at TGE

• Insiders gaming airdrops to receive unlocked tokens at TGE

• VC's and investors being able to stake locked seed round tokens for unlocked rewards

• "DAO theatre" where insiders vote to give themselves token grants

• Team incentives misaligned with users

HyperTrend's "Number Go Up" mechanisms include:

• Zero-emission tokenomics and capped total supply

• Boosted Rewards - Stakers share 20% of trading profits

• Trend Assistance Fund accumulation mechanism

• Staking incentives that lock up supply

• Performance-based team vesting

• Platform usage fees paid in $TREND

HyperTrend Labs has been cashflow positive for the past 3 years with $8M revenue in 2024. Their algorithmic trading systems achieved 63% CAGR over 3 years. The quantitative research is led by @therobotjames, a respected figure in trading communities, with high-frequency execution by Dark Forest Research's team. Additionally, HyperTrend Labs is bootstrapped with no investor or VC involvement, true to the Hyperliquid ethos.

James Hodges (Robot James) is responsible for leading our quant research team and designing our trading algorithms. He has been in the quant research departments at Barclays, Deutsche and Society General. He was Head of the Asia/Pacific arm of the Alfa Financial Software a FinTech in New Zealand. James earned his MSci Physics from University College London.

Liquidity Goblin is responsible for designing our next generation HFT Trade Execution and Market Making capabilities. He is the founder/CEO of Dark Forest Research which started as a defi only MEV firm, moved to CEX/DEX arb, then to include market making. Dark Forest trades on-chain across Ethereum, Solana, and most major CEXs with an 8-figure daily volume.

Yes, our roadmap is split into three phases.

Phase 1: Vault Launch, Pre Token Launch

In Q1, 2026 we will accept deposits to the first trading vault (TLP) in USDC and HYPE. Points accrue to the most generous airdrop in HyperEVM history (40% of supply).

Phase 2: TGE and Exchange Listing

In Q2 2026 points in the airdrop program convert to 40% of unlocked $TREND token supply. $TREND is already listed on Hyperliquid exchange, and we aim to immediately have listings on multiple Tier 1 exchanges.

Phase 3: Open-Source The Platform for Institutional Adoption

Once our own vaults have achieved widespread adoption, we will allow other fund managers and institutions to launch their own on-chain hedge funds with minimal overhead. We will charge 0.2% (20bps) of AUM to run a vault, payable only in $TREND token.

There is a 0.5 to 1.0% redemption fee to cover market impact when exiting positions. Performance fees from the vaults flow to $TREND stakers as USDC rewards. Redemption pricing occurs at net asset value with a fee to account for market impact, with any unused portion of this fee returned to TLP holders.

Redemption Fee Structure:

• 0-6 months: 1%

• 6-12 months: 0.7%

• 12+ months: 0.5%

Vault withdrawals have a 2-week waiting period and are rate-limited to 15% of vault value per fortnight. This allows proper position unwinding without hurting other users. Alternatively, you can sell TLP tokens instantly in AMM pools, similar to other liquid staking tokens.

All trading involves risk. The protocol targets 35% APY with 20% maximum drawdowns, meaning your investment could temporarily decline by up to 20%. However, the team's 3-year track record shows profitability in both bull and bear markets using systematic risk management strategies.

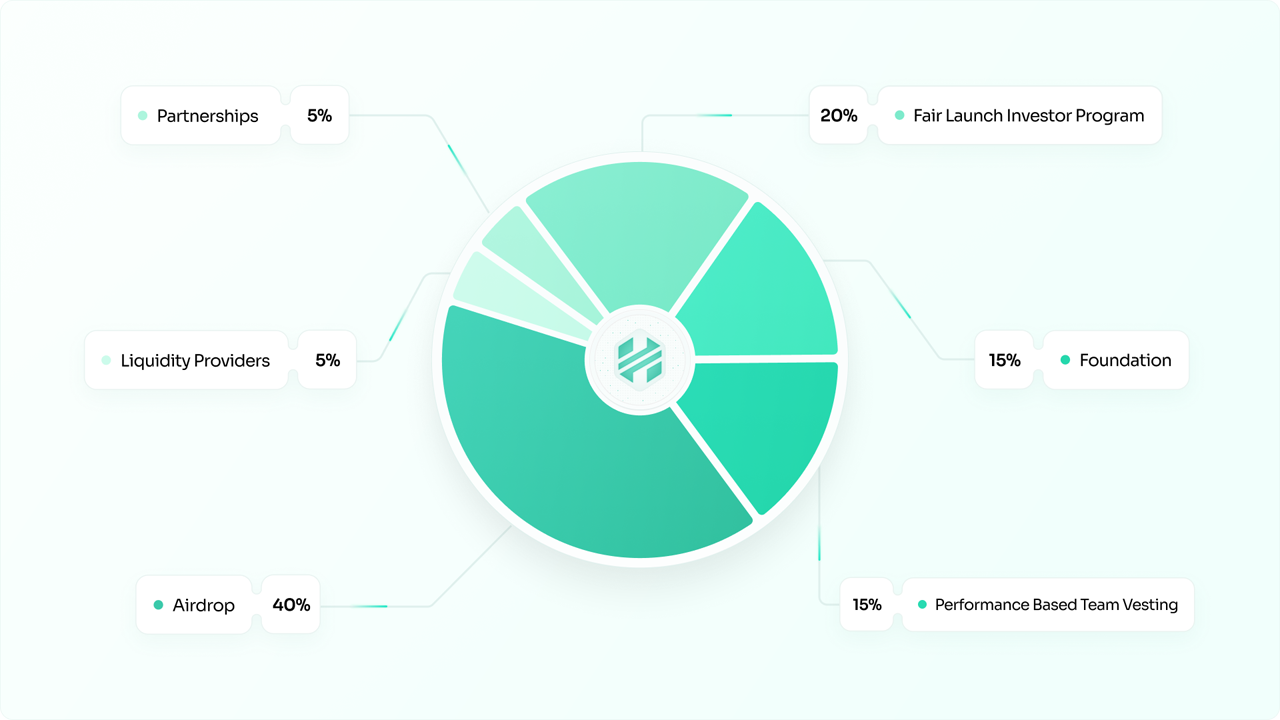

$TREND has a fixed supply of 100 million tokens. Team tokens unlock only after hitting exceptional performance targets, aligning team incentives with token holder success.

Token distribution:

• 40% Airdrop to vault depositors

• 15% team allocation (subject to performance based vesting)

• 5% liquidity providers

• 5% partnerships

• 15% HyperTrend Foundation for ecosystem development and strategic initiatives

• 20% will be available through our fair launch investor program

HyperTrend operates on HyperEVM with LayerZero OFT standard support, enabling bridging to 100+ EVM chains plus Solana and Aptos. This allows cross-chain trading opportunities and broader market access for the algorithmic trading strategies while maintaining the security of the HyperEVM ecosystem.

HyperTrend Labs receives 2% of AUM to cover infrastructure, salary and marketing costs.